Breaking News

Senate Advances Bill to Increase Social Security Benefits… At What Cost to the Taxpayer?

Source: YouTube

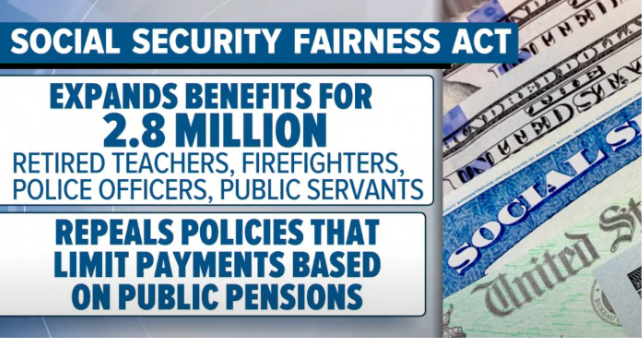

The Senate is poised to vote on the Social Security Fairness Act, a bipartisan bill that seeks to expand Social Security benefits for an estimated 3 million Americans. The proposed legislation aims to eliminate two long-standing provisions—the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO)—which reduce benefits for public sector workers and their spouses. Advocates argue the bill addresses inequities that have financially burdened many retirees, but critics warn of its long-term implications for the Social Security program.

The WEP currently reduces benefits for individuals who receive public pensions from jobs where Social Security payroll taxes were not paid. The GPO, on the other hand, decreases spousal and survivor benefits for those with government pensions. Supporters of the bill, such as Senator Susan Collins (R-Maine), highlight stories of constituents who have been forced back into the workforce due to these reductions. However, the Congressional Budget Office estimates the repeal of these provisions would cost $196 billion over the next decade, hastening Social Security’s insolvency by six months.

Social Security Benefits: A Divided Debate

Proponents of the Social Security Fairness Act, including a bipartisan majority in the Senate, see the bill as a necessary correction to policies they consider outdated and unjust. They argue that teachers, police officers, and other public servants deserve full access to benefits they or their spouses have earned over a lifetime of work. Senator Bill Cassidy (R-Louisiana) shared the story of a Louisiana teacher who saw her monthly survivor benefit slashed to $200 after her husband passed away, calling the situation “an unacceptable penalty on public servants.”

Critics, however, are raising alarms over the bill’s fiscal impact. Senator Thom Tillis (R-North Carolina) described the legislation as “an unfunded $200 billion spending package,” arguing that it ignores the needs of 97% of beneficiaries who will not see any increase in their payments. Other opponents, such as Senator Mike Lee (R-Utah), called for offsetting the costs, warning that the bill would “blow a massive hole in the Social Security trust fund.”

This debate reflects broader concerns about the program's future. Without significant reforms, Social Security’s trust fund is projected to run out in 2033, leaving only 79% of benefits payable. Critics of the bill argue that addressing inequities for some retirees should not come at the expense of the program’s sustainability for all.

Impact on the Trump Administration’s Agenda

If passed, the Social Security Fairness Act could complicate the incoming Trump administration’s fiscal plans. Donald Trump has consistently pledged not to cut Social Security benefits, but his administration may face challenges balancing this promise with the program’s financial strain. The expanded benefits could accelerate insolvency, forcing Trump’s economic team to address funding shortfalls sooner than expected.

Additionally, Trump’s proposed tax cuts and infrastructure spending may increase federal deficits, further constraining resources available for Social Security reform. While the Fairness Act aligns with Trump’s populist appeal to working-class voters, it may create tension between his commitment to preserving benefits and the fiscal realities of his broader agenda.

The Road Ahead for Social Security Benefits

The Senate’s final vote on the Social Security Fairness Act is expected to generate continued debate over the program’s future. Advocates believe the bill represents a step toward fairness for public servants, while critics caution against exacerbating the program’s fiscal challenges.

For the Trump administration, the legislation underscores the delicate balance between fulfilling campaign promises and addressing the financial sustainability of Social Security. As the program approaches a funding crisis, lawmakers will face increasing pressure to craft comprehensive reforms that protect both current and future beneficiaries.

Do you believe expanding Social Security benefits is worth the potential cost to the program’s long-term stability?