Breaking News

As EU Mulls Russian Oil Ban, US Braces for Higher Gas Prices

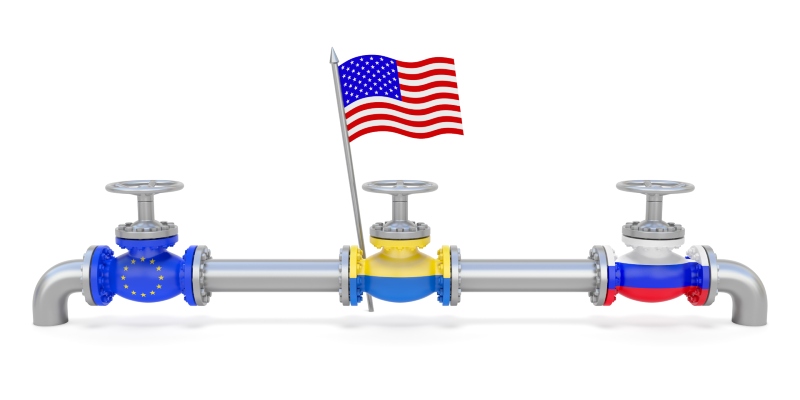

On Wednesday, the European Union proposed a complete Russian oil ban as part of a new round of sanctions against the country. If all 27 member countries approve the measure, it will definitely create a ripple in gas prices worldwide, including in the US.

RELATED: India and China Are Buying Discounted Russian Oil

EU Proposes Russian Oil Ban

As the EU continues to deal with the fallout from Russia’s invasion of Ukraine, the group is now considering additional sanctions. Among its boldest proposals yet is a total Russian oil ban. The EU has yet to share details of the proposal. However, it’s already creating a shockwave within the world markets.

Want to see the full article?

Click here to read the full article on thecapitalist.com

Giving up Russian oil imports remains a risky move for Europe. For decades, the EU depended on Russian imports for around 25% of its oil and natural gas requirements. A total Russian oil ban means looking for suppliers elsewhere. As a result, oil prices jumped by more than 4%. Brent crude prices began trading around $110 per barrel.

Meanwhile, Russia will have to brace for the potential loss of a favored customer. The country might find other customers such as India and China to ramp up their orders. However, it remains unlikely that it can unload its entire EU shipment to someone else.

In addition, the sanctions make it more difficult to deal with Russia. Part of the current proposal includes banning European carriers from transporting Russian oil. Early estimates place Russia’s loss at 2 million barrels of oil per day.

How Will This Impact The EU and US Markets?

At the same time, Russia will likely adjust its strategy once the EU ban goes into effect. A likely scenario would be to raise its crude prices to make up for the loss of EU sales. Other oil producers will likely step up to offer Europeans the oil they need. This added competition for the shrinking supply will elevate prices. The US will also need to deal with higher prices of crude as the EU enters the world market.

Meanwhile, the Organization of Petroleum Exporting Countries (OPEC) will likely do nothing to alleviate the shortage. Prior to the Ukraine-Russia war, Presently, OPEC is already increasing production at the rate of 430,000 barrels per day. However, this is nowhere near enough to address the current demand.

Member countries are having difficulties keeping up with demand, having suspended all expansion efforts during the pandemic. At the same time, Russia remains a strategic partner of OPEC, being one of the “+” members of OPEC+. The group will have to do some soul searching before it supports any moves against a member nation.

What Can The US Do?

For one, the US government is already subsidizing the price of fuel through the release of strategic reserves. Al Salazar, senior vice president with Enverus Intelligence, said that without US intervention, American fuel prices will go much higher.

However, the federal government already capped the release of reserves at one million barrels per day. Anything higher can jeopardize its current stockpile.

At the rate oil prices are swinging, the US might need to hold back on its reserves for even more trying times. Once the US uses up its 180 million barrel allocation, it’s going to be a toss-up.

Meanwhile, critics are also demanding that the US government step up on oil production to reduce dependence on imports. Drilling will take months or years before it can process its first barrel. Labor shortages and supply chain problems are guaranteeing it will even take longer at this point.

In addition, investors of oil companies remain skeptical of any expansion plans. Many companies lost billions during the pandemic. Also, renewed activism against fossil fuels and a movement for renewables are also scaring off companies from investing further.

Should the European Union enforce a total Russian oil ban? Will this help end the war between Ukraine and Russia? Also, will this affect the world oil market and raise fuel prices again?

Tell us what you think. Share your thoughts in the comments section below.