Breaking News

The Trade War Continues As Trump Announces a 200% Tariff on European Wines and Spirits

Source: YouTube

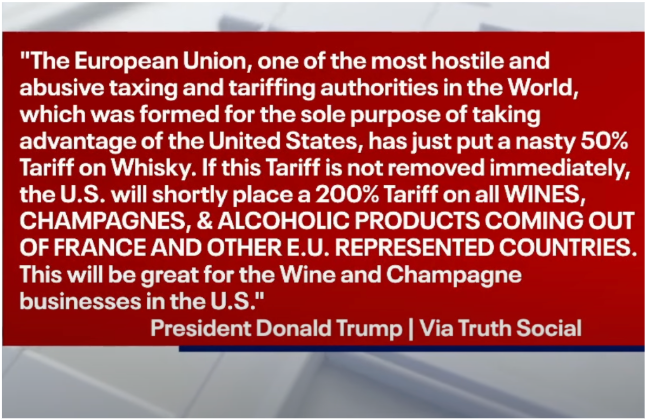

President Donald Trump turned to tariffs again as his primary weapon in trade negotiations. This time, his target is the European Union’s (EU) wine and spirits industry. Following the EU’s announcement of a 50% tariff on American whiskey, Trump countered with a threat to impose a 200% tax on European wines, champagnes, and spirits starting April 1. This latest escalation marks yet another chapter in the ongoing trade war between the U.S. and its supposed allies.

The trade war stems from Trump’s ongoing tariffs on steel and aluminum, which the EU views as unjustified. In response, the bloc decided to impose retaliatory tariffs on American whiskey, an industry that has already suffered from previous trade tensions. European Commission President Ursula von der Leyen confirmed that EU officials are in talks with their U.S. counterparts, but she emphasized that Europe is prepared to defend its economic interests.

The impact of Trump’s move could be severe. European alcohol exports to the U.S. are valued at nearly $4.9 billion annually. Industry leaders warn that a 200% tariff could halt these exports entirely. Gabriel Picard, head of the French Federation of Exporters of Wines and Spirits, stated that such tariffs would be a “hammer blow” to the industry. On the U.S. side, retailers and distributors fear that higher prices will drive consumers to alternative markets.

The economic consequences of this trade war are already visible. Stock markets reacted negatively to Trump’s latest announcement, with the S&P 500 falling 1.4% and European alcohol stocks experiencing significant losses. Meanwhile, U.S. whiskey makers, including major brands from Kentucky and Tennessee, have urged Trump to negotiate a trade deal rather than continue escalating the conflict.

Why Trump Is Doubling Down on Tariffs

The administration’s push for tariffs goes beyond mere retaliation. His broader strategy aims to shift the U.S. government’s revenue model by prioritizing import taxes over domestic income taxes. His long-term plan, as outlined in recent statements, is to generate enough revenue from tariffs to eliminate income taxes for Americans earning $150,000 or less.

Trump argued that tariffs force foreign companies to pay the U.S. government directly while protecting domestic industries. This approach, he claims, could replace billions in lost tax revenue while simultaneously reshoring manufacturing jobs. However, critics argue that tariffs ultimately act as a hidden tax on American consumers, as companies pass higher costs onto buyers. Trump remains undeterred despite the criticisms.

Trump’s tariff strategy also aims to bring manufacturing back to the U.S. by making foreign goods more expensive and incentivizing domestic production. However, switching to local manufacturing isn’t as easy as it seems. High labor costs and supply chain complications make large-scale reshoring difficult. Despite these hurdles, the President continues to push tariffs as a tool to reshape trade and boost American manufacturing.

Will Tariffs Work as a Long-Term Strategy?

Trump’s trade war is designed to pressure foreign governments and boost domestic revenue. However, history suggests that trade wars rarely produce clear winners. While tariffs can provide short-term leverage, they often lead to retaliatory measures that harm businesses on both sides. The EU has made it clear that it will not back down without a fight, and further escalation could disrupt global supply chains.

For now, the standoff between the U.S. and the EU continues, with consumers and businesses caught in the middle. As Trump pushes forward with his aggressive tariff strategy, the question remains: will this trade war strengthen the U.S. economy, or will it backfire, leading to further economic uncertainty?

Do you think Trump’s trade war policies will benefit the U.S. economy in the long run? Tell us what you think!