Politics

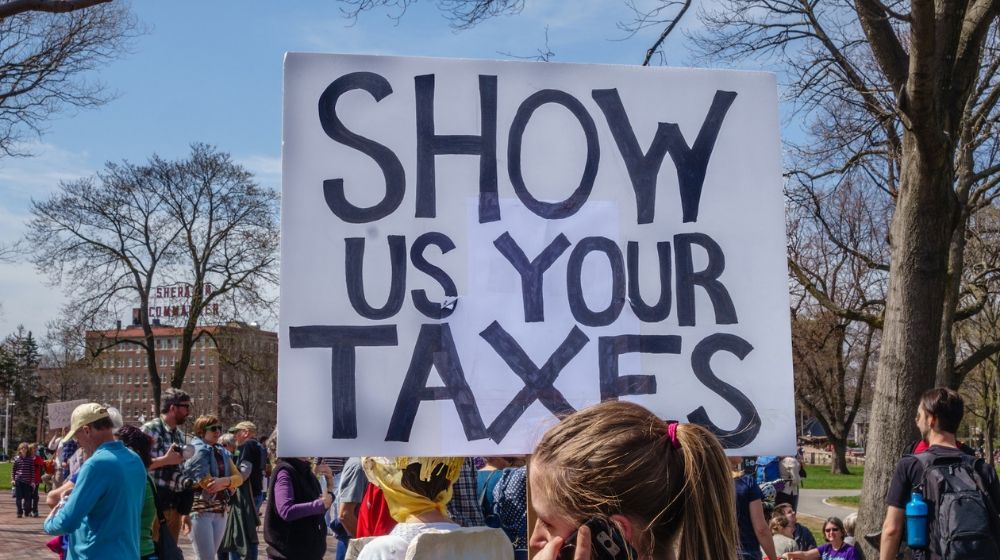

Can A State Legally Force Presidential Candidates To Disclose Their Tax Returns And Impose Other Requirements?

Last week, I wrote about the California Supreme Court’s decision striking down a law that required potential presidential candidates to publicly disclose their tax returns in order to appear on the state ballot. But another state might try a similar tactic. And if the state’s supreme court allows the disclosure law to stand, the Trump administration is likely to appeal to the U.S. Supreme Court as the tax returns would soon be available to everyone on the internet almost immediately afterward.

Article 2, Section 1, Clause 5 of the U.S. Constitution states that, to be President, the candidate must be at least thirty-five years old, a natural-born citizen, and must have lived in the United States for at least 14 years.

Would the nation’s highest court allow states to impose their own requirements — in this case, disclosing income tax returns to the public — in addition to the qualifications written out in the U.S. Constitution? The Supreme Court has previously addressed the qualification clause where the state legislature tried to impose additional requirements on candidates seeking to run for federal office.

In U.S. Term Limits, Inc. v. Thornton, the Supreme Court held that states cannot impose additional requirements for potential candidates seeking federal congressional seats other than those stated in the qualification clauses of the Constitution. The court noted that according to the Constitution’s framers, the sovereignty is vested in the people and confers on them the right to freely choose their representatives to the national government. Allowing state legislatures to impose their own requirements would hinder the people’s ability to choose, prevent uniformity in selecting national representatives, and would ultimately undermine the national government.

The dissent argued that the Tenth Amendment allows states to impose their own additional requirements since the U.S. Constitution is silent on the issue. The majority addressed this by noting that the Tenth Amendment does not apply because the framers did not want states to impose additional requirements for federal congressional seats.

Can the holding in Thornton apply to any state that seeks a candidate’s tax returns before allowing that candidate to appear on the state’s ballot? Using the majority’s reasoning, a state should not be allowed to impose additional requirements even using the Tenth Amendment. By imposing additional requirements, a state would be attempting to undermine the national government by filtering who can run for office.

[wps_products_gallery product_id=”4335616426035, 4333818544179, 4334008467507″]

However, Thornton can be distinguished on the ground that, according to the U.S. Constitution, the president is not elected by the people but by the Electoral College. The U.S. Constitution provides that the state legislatures appoint the electors in a manner that they direct. Perhaps a state can require prospective electors to have a copy of every presidential candidate’s tax returns to be eligible to vote.

Thornton was a 5-4 decision with the majority vote coming from the liberal wing of the court along with Justice Kennedy. Today, only three of the justices who decided the 1995 case (Thomas, Ginsburg, and Breyer) remain on the court. How would the Supreme Court decide the case today?

If the justices vote based on ideology as was done in Thornton, the slight conservative majority should be in favor of letting states impose additional requirements in order to be placed on the state ballot, including disclosing tax returns. However, it would not please the current Republican president who appointed two of the justices. The liberal minority can comfortably maintain their position that states should not tamper with the qualification clause of the U.S. Constitution. All eyes would likely fall on Justices Gorsuch and Kavanaugh to see if they would side with the liberals.

This issue can be a slippery slope. Today, states are demanding tax returns. In the future, other states might want long-form birth certificates. Or marriage records if the candidate is running on family values.

A prudent legislative body would consider the effect of such disclosure laws in the long run. Particularly if a candidate they prefer would also object to disclosing such information. But today, it has gotten to the point where state governments can quickly pass disclosure laws like this targeting a particular candidate if they really wanted to. And they can quickly repeal such laws once their disfavored candidate is no longer in the running.

So what would happen if states were allowed to require candidates to disclose their past income tax returns? Or any other personal information for that matter? Election campaign strategies might change. Maybe they will cough up the information the states want. Or the candidates might ignore them and their electoral votes. President Trump needs California’s votes as much as a fish needs a bicycle. But he might also pay less attention to states where he is certain to win.

It could be a potential problem where Trump is likely to win the popular vote in a state but the state government is run by Democrats. What if the legislators of this state were to pass a tax return disclosure law? Unless the majority of the voters can vote for Trump as a write-in candidate, the state government can effectively shut them out.

Would the founding fathers want presidential candidates to publicize their income tax returns? That’s impossible to know since the income tax return was created in 1913. Maybe they would. Or maybe not. But what they didn’t want was someone who would act like an elected monarch.

But in the final analysis, should a legislature be allowed to filter who gets to run for president in its state? My opinion is no. The people can decide whether a tax return or a birth certificate is important enough to allow a candidate to run for president. Who knows what Trump’s tax returns contain? Maybe it shows income from the Russians. Or maybe it shows that his income was $100,000 instead of $100 million. Most people might want to see it out of curiosity, but I doubt most Trump supporters will change their vote regardless of what the returns contain.

If state governments are allowed to impose additional requirements, what’s to stop cities and counties from doing the same thing? It can result in all kinds of disclosure requirements which can deter good but imperfect people from running for office.

It would be interesting to see if the U.S. Supreme Court would apply the holding and reasoning of Thornton for states seeking to impose additional requirements for presidential candidates in addition to those enumerated in the U.S. Constitution. The Thornton decision was a close one and, almost 25 years later, the Supreme Court’s makeup has changed. This means the decision on the issue will be unpredictable. Will the Supreme Court respect the framers’ intentions? Or will they side with the states? While state legislatures should have a voice on how the president is elected, in this day and age, some states could use this opportunity for legislative mischief that can undermine the national elections.

Steven Chung is a tax attorney in Los Angeles, California. He helps people with basic tax planning and resolve tax disputes. He is also sympathetic to people with large student loans. He can be reached via email at [email protected]. Or you can connect with him on Twitter (@stevenchung) and connect with him on LinkedIn.

(c) 2019 Breaking Media, Inc. All rights reserved. Provided by SyndiGate Media Inc. (Syndigate.info).